Pound to Euro Exchange Rate Outlook: Today's GBP/EUR Trades Higher on Scottish Currency Speculation

August 26, 2014 - Written by James Fuller

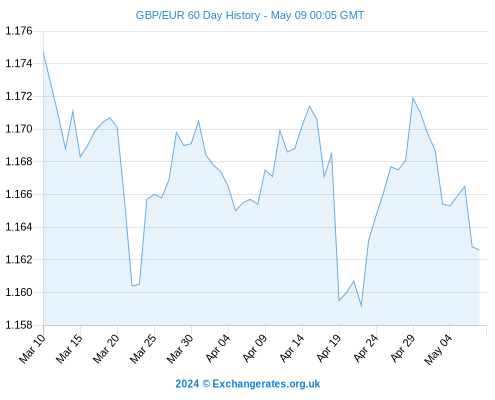

The UK Pound Sterling (GBP) achieved some gains versus the Euro (EUR) this week following the prospect of the European Central Bank (ECB) needing to implement Quantitative Easing methods.

The UK Pound Sterling (GBP) achieved some gains versus the Euro (EUR) this week following the prospect of the European Central Bank (ECB) needing to implement Quantitative Easing methods.

The Euro exchange rate complex sunk to 11-month lows in the currency market against strong majors such as the US Dollar (USD) and Pound (GBP) whilst falling to even weaker 19-month troughs against the Swiss Franc (CHF).

The single currency is likely to face fierce headwinds by way of monetary policy decisions and Thursday and Friday’s expected Consumer Price Index figures. The Pound to euro exchange rate (GBP/EUR) could gain if the Eurozone’s figures remain unimpressive.

Where does the European unit stand in today's forex markets:

- The pound to euro exchange rate is -0.02 per cent lower at 1.25619.

- The euro to pound exchange rate is +0.02 per cent higher at 0.79606.

- The euro to dollar exchange rate is -0.14 per cent lower at 1.31677.

- The dollar to euro exchange rate is +0.14 per cent higher at 0.75944.

The Euro has seen the effects of President of the European Central Bank, Mario Draghi’s, statements at the Jackson Hole conference, which dominated talks in the market last week as investors speculated the outcome of such influential banking leaders discussing their stance on global economics, the labour market, and monetary policy. Draghi however inspired confidence that he will put in place measures for the Eurozone recovery to become stronger. However, the President also directly commented off the cuff about low inflation rates which have plagued the Eurozone for some time.

Draghi stated: ‘Inflation has been on a downward path from around 2.5% in the summer of 2012 to 0.4% most recently. I comment on these movements about once a month in the press conference, and I have given several reasons for this downward path in inflation, saying it is because of food and energy price declines; because after mid-2012 it is mostly exchange rate appreciation that has impacted on price movements; more recently we have had the Russia-Ukraine geopolitical risks, which will also exert a negative impact on the Euro area economy and of course we had the relative price adjustment that had to happen in the stressed countries as well as high unemployment. I have said in principle most of these effects should in the end wash out because most of them are temporary in nature—though not all of them.’

Draghi continued to confront the issues of low inflation head-on without allowing excuses to continue, stating that the ECB will use ‘all the available instruments needed to ensure price stability over the medium term’ in light of the factors that have contributed in the failure of reaching inflation rate targets. This lends to the speculative idea that the European Central Bank may resort to extreme measures to ward off the threat of deflation. However, Draghi has faced criticism in the past for speaking and not acting. Expert in the field Laurence Mutkin commented: ‘Markets have begun doubting whether they should give full credibility to what Mr Draghi says about inflation and the possibility of full-blown QE. They don’t doubt his sincerity but judge the ECB by its actions—inflation has undershot its target and it keeps not doing QE.’

Monday however saw German IFO Business Climate, Current Assessment, and Expectations figures fall short of expectations which will lend no support to the Euro.

Latest GBP/EUR Exchange Rate Predictions:

The Pound Conversely has been trading amid speculation of the outcome of the Scottish Referendum and the implications that will become evident in the Pound following such an influential event. Current guesswork imagines that one of an independent Scotland’s options could involve using the Euro. The future of the Pound to Euro exchange rate however will be largely dependent on the release of Eurozone data this week, as the UK sees a quiet day for data publication. Friday however will see UK Consumer Confidence figures released which may encourage the Pound to gain in the currency market. Meanwhile the Eurozone is scheduled to publish Consumer Price Index figures on Thursday and Friday which are expected to highlight the low inflationary levels the Eurozone struggles with at the present time.

STORY LINK Pound to Euro Exchange Rate Outlook: Today's GBP/EUR Trades Higher on Scottish Currency Speculation

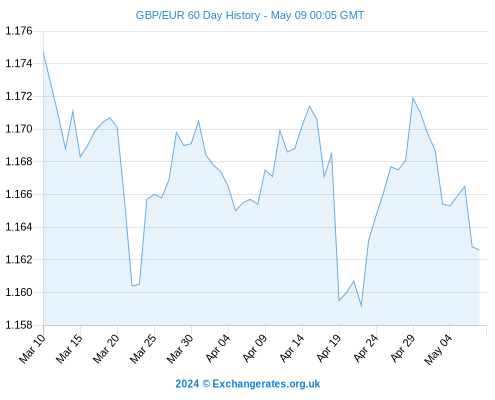

The Euro exchange rate complex sunk to 11-month lows in the currency market against strong majors such as the US Dollar (USD) and Pound (GBP) whilst falling to even weaker 19-month troughs against the Swiss Franc (CHF).

The single currency is likely to face fierce headwinds by way of monetary policy decisions and Thursday and Friday’s expected Consumer Price Index figures. The Pound to euro exchange rate (GBP/EUR) could gain if the Eurozone’s figures remain unimpressive.

Where does the European unit stand in today's forex markets:

- The pound to euro exchange rate is -0.02 per cent lower at 1.25619.

- The euro to pound exchange rate is +0.02 per cent higher at 0.79606.

- The euro to dollar exchange rate is -0.14 per cent lower at 1.31677.

- The dollar to euro exchange rate is +0.14 per cent higher at 0.75944.

Pound to Euro Forecast to Depreciate as Eurozone Recovery Leans Towards Quantitative Easing

The Euro has seen the effects of President of the European Central Bank, Mario Draghi’s, statements at the Jackson Hole conference, which dominated talks in the market last week as investors speculated the outcome of such influential banking leaders discussing their stance on global economics, the labour market, and monetary policy. Draghi however inspired confidence that he will put in place measures for the Eurozone recovery to become stronger. However, the President also directly commented off the cuff about low inflation rates which have plagued the Eurozone for some time.

Draghi stated: ‘Inflation has been on a downward path from around 2.5% in the summer of 2012 to 0.4% most recently. I comment on these movements about once a month in the press conference, and I have given several reasons for this downward path in inflation, saying it is because of food and energy price declines; because after mid-2012 it is mostly exchange rate appreciation that has impacted on price movements; more recently we have had the Russia-Ukraine geopolitical risks, which will also exert a negative impact on the Euro area economy and of course we had the relative price adjustment that had to happen in the stressed countries as well as high unemployment. I have said in principle most of these effects should in the end wash out because most of them are temporary in nature—though not all of them.’

Draghi continued to confront the issues of low inflation head-on without allowing excuses to continue, stating that the ECB will use ‘all the available instruments needed to ensure price stability over the medium term’ in light of the factors that have contributed in the failure of reaching inflation rate targets. This lends to the speculative idea that the European Central Bank may resort to extreme measures to ward off the threat of deflation. However, Draghi has faced criticism in the past for speaking and not acting. Expert in the field Laurence Mutkin commented: ‘Markets have begun doubting whether they should give full credibility to what Mr Draghi says about inflation and the possibility of full-blown QE. They don’t doubt his sincerity but judge the ECB by its actions—inflation has undershot its target and it keeps not doing QE.’

Monday however saw German IFO Business Climate, Current Assessment, and Expectations figures fall short of expectations which will lend no support to the Euro.

Latest GBP/EUR Exchange Rate Predictions:

The Pound Conversely has been trading amid speculation of the outcome of the Scottish Referendum and the implications that will become evident in the Pound following such an influential event. Current guesswork imagines that one of an independent Scotland’s options could involve using the Euro. The future of the Pound to Euro exchange rate however will be largely dependent on the release of Eurozone data this week, as the UK sees a quiet day for data publication. Friday however will see UK Consumer Confidence figures released which may encourage the Pound to gain in the currency market. Meanwhile the Eurozone is scheduled to publish Consumer Price Index figures on Thursday and Friday which are expected to highlight the low inflationary levels the Eurozone struggles with at the present time.

International Money Transfer? Ask our resident FX expert a money transfer question or try John's new, free, no-obligation personal service! ,where he helps every step of the way, ensuring you get the best exchange rates on your currency requirements.

TAGS: Currency Predictions Daily Currency Updates Euro Forecasts

Comments are currrently disabled

Related Stories:

- Goldman Sachs: Pound Sterling Tipped at 1.35 vs Dollar in 12 months - December 24, 2023

- Euro to Dollar Outlook 2024: HSBC Now Predicts Above 1.10 - December 20, 2023

- Euro to Dollar Forecast 2024: Odds of 1.20 Next Year "Very Slim Indeed" says Juckes - December 18, 2023

- Pound to Dollar: Twelve-Month Forecasts Raised to 1.30 at Goldman Sachs - December 18, 2023

- Euro to Dollar Outlook: Is a move towards 1.12 on the radar asks Scotiabank - December 15, 2023

- Pound to Dollar 2024 Outlook: ECB to Slash Rates First, Then FED, BoE - December 7, 2023

- Euro to Dollar Forecast: 1.04 in Next 12 Months say Danske - December 7, 2023

- Euro to Dollar Q1 2024 Forecast: Parity Call say Morgan Stanley - December 3, 2023

- The Pound to Dollar: Forecasts see Possible Gains to 1.2745, say UoB - December 1, 2023

Latest News:

- Sterling Recovery Continues, Pound to Dollar Rate Above 1.25 - April 25, 2024

- Pound to Euro: Back Above 1.1625, Short-Term Stabilisation Ahead - April 24, 2024

- Pound Sterling Rebounds After UK and US PMI Data Jolts Expectations - April 24, 2024

- Pound to Dollar Rate Secures Net Gain to 1.2370 - April 23, 2024

- Euro to Dollar Parity Forecasts: "Bearish Outlook from Here" say Credit Agricole - April 21, 2024

- Pound to Dollar Week Ahead Outlook: Latest GBP/USD Forecast Ranges - April 21, 2024

- Pound to Euro Week Ahead Forecast: 1.1240-1.2050 12-Month Ranges - April 21, 2024

- Euro to Pound Forecast: EUR/GBP at 0.8540 "Likely to Drift Higher" say SocGen - April 19, 2024

- Pound to Dollar: Sticky UK Services Inflation Boosts Sterling Exchange Rates - April 18, 2024

- Pound Sterling Today: GBP Gains as UK Inflation Higher than Expected - April 17, 2024