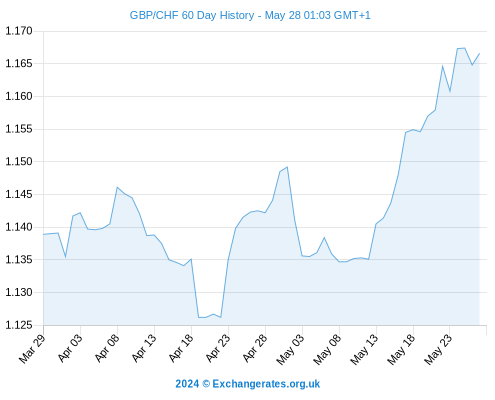

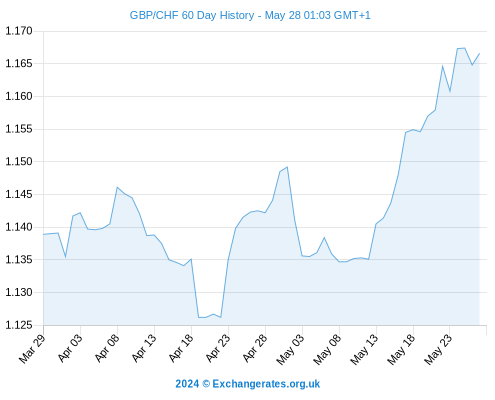

British Pound to Swiss Franc Exchange Rate Today - GBP/CHF Holds Firm After UK PMI Data

July 1, 2014 - Written by Frank Davies

The Pound made gains against the Swiss Franc on Tuesday after the latest Markit manufacturing purchasing managers index (PMI) data came in above expectations, increasing optimism over the UK economy and increasing speculation that the Bank of England will raise interest rates before the end of this year.

The Pound made gains against the Swiss Franc on Tuesday after the latest Markit manufacturing purchasing managers index (PMI) data came in above expectations, increasing optimism over the UK economy and increasing speculation that the Bank of England will raise interest rates before the end of this year.

Earlier in the session the Swiss Franc found support against a number of its most traded peers as a report released by Credit Suisse showed that manufacturing activity in the alpine nation continued to expand for a fourteenth consecutive month in June.

According to the report the PMI rose unexpectedly to 54, up from the previous figure of 52.5 and beat economist expectations for a decline to 52.3. The cause of the rise was being attributed to the increase in a backlog of orders. The backlog climbed by 8.1 points to 58.9. The employment sub-index slipped by 2.3 points to a reading of 48.4.

On the index, a reading above 50.0 indicates expansion, below indicates contraction.

Against the Euro the Franc was little changed despite data widely disappointing for the 18-member currency bloc.

The first batch of data showed that factory growth in Germany (Europe’s largest economy) fell in June to its slowest pace since October 2013. The German manufacturing PMI fell to 52 from 52.4. The high value of the Euro was being blamed.

“June’s survey results pointed to slower growth in Germany’s goods producing sector with the headline PMI falling to an eight-month low. Output and new order growth continued to slow, which our panel members in many cases linked to production adjustments after strong growth had been reported at the beginning of the year. In line with the weaker trends for output and new orders, companies were reluctant to take on additional workers during June, thereby ending a six-month period of continuous job creation. Meanwhile, client demand from foreign markets rose to the weakest extent in the current spell of growth, suggesting that a relatively strong euro is acting as a drag on stronger export growth and may continue to do so in coming months,” said an economist from Markit.

Also weighing upon the Euro was the release of other data reports which showed that Eurozone manufacturing declined in June and as unemployment remained close to record high levels.

The British Pound forecast improves on UK PMI

As the session progressed the Pound climbed against the majority of its most traded peers after manufacturing data out of the UK beat forecasts.

Factory PMI out of the UK jumped to a seven-month high of 57.5 in June showing that growth accelerated from the already strong 57.0 recorded in May.

“The level of incoming new business rose at the fastest pace since November 2013 and to one of the greatest extents since the survey began in 1992. The domestic market remained the prime source of new contract wins, although inflows of new export business also strengthened,” said Markit and CIPs following the report’s release.

The positive PMI data followed on from a separate report issued by the Confederation of British Industry which showed that demand at UK factories climbed in June and that order books were at their fullest since last December.

“It’s hard to not conclude the UK good-news story is continuing. Manufacturing is growing strongly, and work flows suggest this has legs. As this news flow is absorbed further, rate hike expectations for the first hike in the fourth quarter this year should harden,” said an economist at BNP Paribas SA.

With no further economic data releases due for Switzerland this week the Alpine currency will be impacted by events elsewhere. Investors continue to be wary of events in Iraq, North Korea and Ukraine. If the fight in Iraq goes badly for the Iraqi government or today’s ending of a ceasefire in Ukraine leads to more bloodshed we can expect the Franc to find support from safe haven demand.

The Pound was firmer against the Franc on Wednesday as the currency continued to receive support from yesterday’s positive manufacturing PMI data. The Pound could make further gains if today’s Construction PMI data comes in positively.

The Swiss Franc meanwhile found support following the release of a PMI report which showed a rise to its best level in 2-months. The PMI rose to 54.0 in June, from an earlier month’s reading of 52.5.

The Pound to Swiss Franc exchange rate is at 1.52602 GBP/CHF.

The Euro to Swiss Franc exchange rate is trading up +0.03% at 1.21454 EUR/CHF.

The US Dollar to Swiss Franc exchange rate is trading up +0.04% at 0.88967 USD/CHF.

STORY LINK British Pound to Swiss Franc Exchange Rate Today - GBP/CHF Holds Firm After UK PMI Data

Earlier in the session the Swiss Franc found support against a number of its most traded peers as a report released by Credit Suisse showed that manufacturing activity in the alpine nation continued to expand for a fourteenth consecutive month in June.

According to the report the PMI rose unexpectedly to 54, up from the previous figure of 52.5 and beat economist expectations for a decline to 52.3. The cause of the rise was being attributed to the increase in a backlog of orders. The backlog climbed by 8.1 points to 58.9. The employment sub-index slipped by 2.3 points to a reading of 48.4.

On the index, a reading above 50.0 indicates expansion, below indicates contraction.

Against the Euro the Franc was little changed despite data widely disappointing for the 18-member currency bloc.

The first batch of data showed that factory growth in Germany (Europe’s largest economy) fell in June to its slowest pace since October 2013. The German manufacturing PMI fell to 52 from 52.4. The high value of the Euro was being blamed.

“June’s survey results pointed to slower growth in Germany’s goods producing sector with the headline PMI falling to an eight-month low. Output and new order growth continued to slow, which our panel members in many cases linked to production adjustments after strong growth had been reported at the beginning of the year. In line with the weaker trends for output and new orders, companies were reluctant to take on additional workers during June, thereby ending a six-month period of continuous job creation. Meanwhile, client demand from foreign markets rose to the weakest extent in the current spell of growth, suggesting that a relatively strong euro is acting as a drag on stronger export growth and may continue to do so in coming months,” said an economist from Markit.

Also weighing upon the Euro was the release of other data reports which showed that Eurozone manufacturing declined in June and as unemployment remained close to record high levels.

The British Pound forecast improves on UK PMI

As the session progressed the Pound climbed against the majority of its most traded peers after manufacturing data out of the UK beat forecasts.

Factory PMI out of the UK jumped to a seven-month high of 57.5 in June showing that growth accelerated from the already strong 57.0 recorded in May.

“The level of incoming new business rose at the fastest pace since November 2013 and to one of the greatest extents since the survey began in 1992. The domestic market remained the prime source of new contract wins, although inflows of new export business also strengthened,” said Markit and CIPs following the report’s release.

The positive PMI data followed on from a separate report issued by the Confederation of British Industry which showed that demand at UK factories climbed in June and that order books were at their fullest since last December.

“It’s hard to not conclude the UK good-news story is continuing. Manufacturing is growing strongly, and work flows suggest this has legs. As this news flow is absorbed further, rate hike expectations for the first hike in the fourth quarter this year should harden,” said an economist at BNP Paribas SA.

With no further economic data releases due for Switzerland this week the Alpine currency will be impacted by events elsewhere. Investors continue to be wary of events in Iraq, North Korea and Ukraine. If the fight in Iraq goes badly for the Iraqi government or today’s ending of a ceasefire in Ukraine leads to more bloodshed we can expect the Franc to find support from safe haven demand.

GBP/CHF Update 02/07/2014

The Pound was firmer against the Franc on Wednesday as the currency continued to receive support from yesterday’s positive manufacturing PMI data. The Pound could make further gains if today’s Construction PMI data comes in positively.

The Swiss Franc meanwhile found support following the release of a PMI report which showed a rise to its best level in 2-months. The PMI rose to 54.0 in June, from an earlier month’s reading of 52.5.

Swiss Franc Exchange Rates (Money Transfer to Switzerland) - 03/07/2014

The Pound to Swiss Franc exchange rate is at 1.52602 GBP/CHF.

The Euro to Swiss Franc exchange rate is trading up +0.03% at 1.21454 EUR/CHF.

The US Dollar to Swiss Franc exchange rate is trading up +0.04% at 0.88967 USD/CHF.

International Money Transfer? Ask our resident FX expert a money transfer question or try John's new, free, no-obligation personal service! ,where he helps every step of the way, ensuring you get the best exchange rates on your currency requirements.

TAGS: Currency Predictions Daily Currency Updates Swis Forecasts

Comments are currrently disabled

Related Stories:

- Pound to Dollar Rate Forecast: 1.32 Hold as "GBP Most to Lose" - May 18, 2025

- Euro to Dollar Forecast for Next Week: EUR to Extend 1.12 Consolidation - May 18, 2025

- Pound to Euro Week Ahead Forecast: 1.19 Today, 1.15-1.2050 in 12 Months - May 18, 2025

- Euro to US Dollar Forecast: EUR Drifts Into "Bearish Territory" - May 15, 2025

- Pound Sterling to Euro Forecast: GBP to Weaken to 1.15 vs EUR in 2025 - May 13, 2025

- Euro to Dollar Forecast: 1.17 by 2026, 1.24 by 2027 say RBC - May 11, 2025

- Pound to Dollar Forecast: 1.45 if USD Reverts to Historic Mean - May 11, 2025

- Pound to Euro Week Ahead Forecast: 1.182 Today, 1.2 by 2026 - May 11, 2025

- Pound to Dollar Forecasts Maintain "Downside Risk" say UoB - May 9, 2025

Latest News:

- GBP/USD Forecast: Pound Sterling "Mid Performer" Following US, UK PMIs - May 23, 2025

- Pound-to-Euro Rate Nears 1.19 as UK Outperforms EU PMI Data - May 23, 2025

- Euro to Dollar Price Forecast: Stalls at 1.1350, EUR Bullish Trend - May 22, 2025

- Pound to US Dollar Forecast: "Trend in GBPUSD Remains Bullish" - May 22, 2025

- Pound to Euro Rate Ticks Higher, But Markets on High Alert - May 22, 2025

- Pound-Euro Exchange Rate Dented despite Surge in UK CPI - May 21, 2025

- GBP/USD Forecast: Pound Finds Fleeting Gains vs Dollar as UK Inflation Soars - May 21, 2025

- Euro to Dollar Forecast: Danske Hold 12 Month Target of 1.20 - May 21, 2025

- Pound-to-Euro Forecast: GBP/EUR Gains Above 1.1900 say Analysts - May 21, 2025

- Pound to Dollar Forecast: GBP Gains on USD Weakness, UK Inflation - May 21, 2025